iGaming payment processing is different from regular online financial transactions due to a variety of reasons.

In 2022, online gamblers bet about a trillion dollars—that’s a lot of cash flow!

This incredible number emphasizes the rapid expansion and possibilities in the iGaming industry. At Fikson.com, we are keenly aware of this trend. As the sector evolves, effective and secure payment processing becomes absolutely vital for online casinos and sportsbooks to attract and retain users.

Leading SEO agency Fikson understands the critical importance of incorporating the best iGaming payment options into your newly created websites.

You can’t just use any payment gateway.

These solutions are your ticket to a better user experience, minimized risks and seamless transactions. With our unrivaled expertise in iGaming payment processing — from cutting-edge digital wallet integration to comprehensive gaming merchant accounts — Fikson ensures your business doesn’t just compete in this highly competitive market but dominates it.

Written by our experienced experts at Fikson, this guide takes an in-depth look at the best iGaming payment processing options and highlights their unique features and benefits for your online gaming platform. Whether you’re just starting out in iGaming or are an experienced operator, this article will provide you with the crucial insights and strategies you need to get ahead of the competition and master the complexities of payment processing.

So, let’s dive in!

What Are iGaming Payment Solutions?

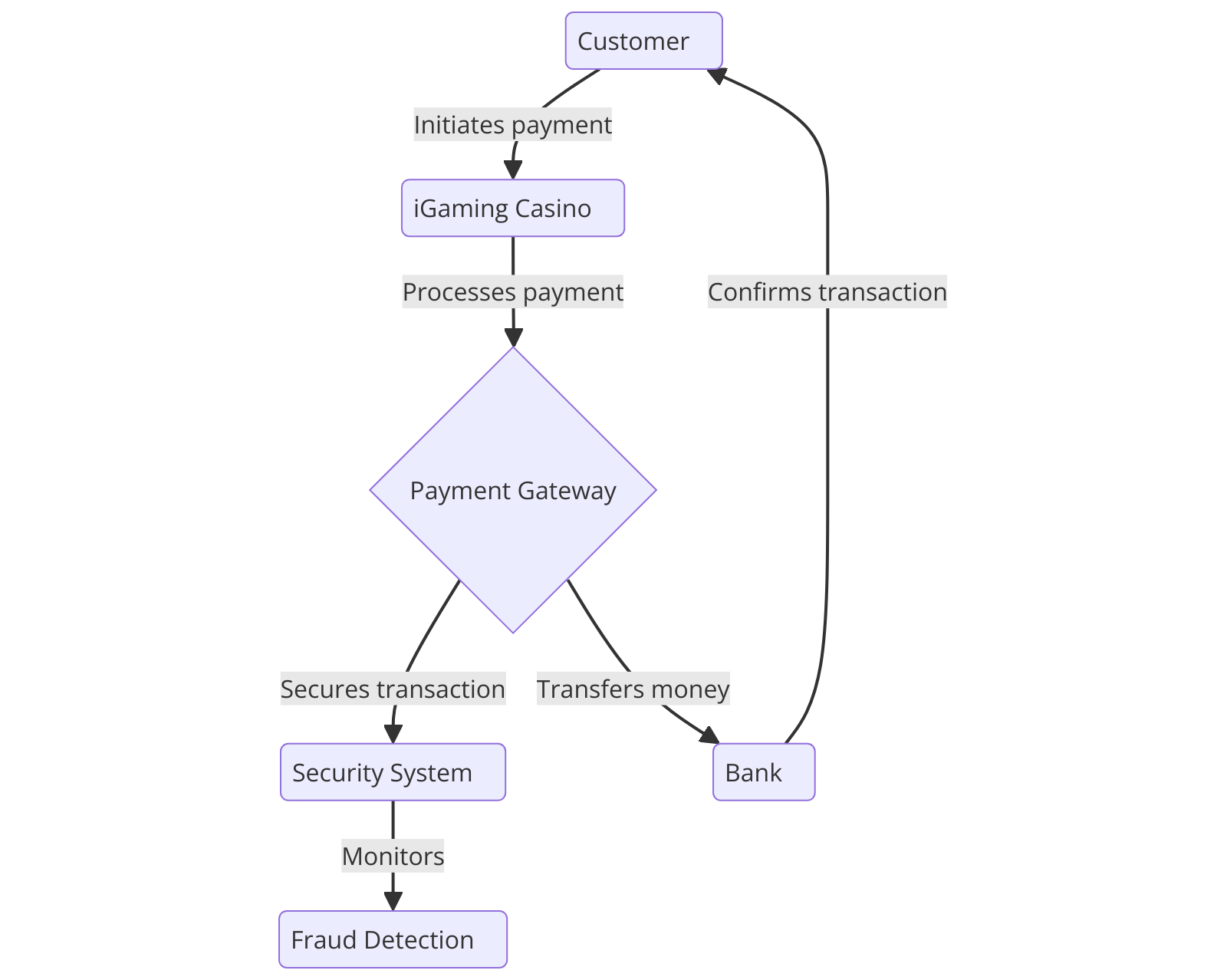

When you dive into online gaming, having reliable payment methods is a game-changer. They make it easy and safe for players to deposit and withdraw money without any headaches. But it’s not just about convenience—these transactions are backed by strong security measures and strict legal rules that online casinos must follow to keep everything running smoothly and securely.

Now, you probably ask, how this works?

Key Components of iGaming Payment Solutions

- Safe and Quick Payment Handling: Credit, debit, and alternative payment processing.

- Regulatory Compliance: Adherence to industry-specific regulations and data security guidelines.

- Fraud Prevention: Automated fraud prevention techniques and risk management systems.

- Financial Optimization: Comprehensive reporting and financial analytics.

- Seamless Integration: Smooth integration between mobile apps and internet gambling sites.

These specific payment solutions help online gaming companies maintain a competitive advantage in the ever-changing iGaming market, significantly enhance the user experience, and build player loyalty.

Top iGaming Payment Solution Providers

In the iGaming field, choosing trustworthy and secure payment methods is paramount. We have closely examined the top payment systems used by sports betting platforms and online casinos, including PayPal, Skrill, Neteller, Trustly, AstroPay, Genome, Neosurf, Interac, Jeton, and MuchBetter.

A Closer Look at Payment Providers

| Provider | Unique Features & Benefits |

|---|---|

| PayPal | Handles over 3 trillion transactions annually but at a higher transaction fee. |

| Skrill | Offers discounted rates and enhanced limits through its VIP club and loyalty program. |

| Neteller | Charges zero fees on international money transfers, with higher withdrawal fees in some local areas. |

| Trustly | Specializes in account-to-account (A2A) payments, reducing dependency on intermediaries. |

| AstroPay | Focuses on virtual card processing, offering a safe payment mechanism for emerging markets. |

| Paysafe | Distinguishes itself with over 250 payment options across 120+ countries, appealing to a global audience. |

| MuchBetter | Known for its marketing solutions for online casinos and sports betting. |

What to Look for When Choosing a Payment Provider?

Choosing the correct payment method for your iGaming business will significantly impact user experience, transaction success rates, and compliance with industry regulations. Understanding the features and capabilities of these leading iGaming payment providers will help you make an informed decision to maximize your operations and simplify payment handling.

A safe, quick, and user-centric experience depends on selecting the right payment provider. Companies must prioritize features that ensure seamless and secure transactions. These include:

- Security: Multi-factor authentication, fraud detection systems, and advanced encryption.

- Global Payment Acceptance: Support for credit/debit cards, e-wallets, bank transfers, and cryptocurrencies.

- Efficient Transaction Processing: Capability to handle high traffic, quick processing, and fast deposit/withdrawal times.

- 24/7 Customer Support: Essential for resolving issues promptly and maintaining trust.

Examining the Top 10 iGaming Payment Providers

We thoroughly researched the top 10 iGaming payment providers, evaluating both established names like PayPal and Skrill and newer platforms such as Trustly and Jeton. Each provider offers unique features, benefits, and considerations for both players and iGaming operators.

Detailed Comparison

| Provider | Minimum Payout | Supported Payment Systems | Transaction Charges | Customer Support |

|---|---|---|---|---|

| PayPal | $50 – $100 | Credit/Debit Cards; Bank Transfers | 2.9% + $0.30 | 24/7 live chat, email, phone |

| Skrill | $30 minimum | Credit/Debit Cards, Bank Transfers | 1.9% – 3.9% | 24/7 live chat, email |

| Neteller | $10 – $20 | Credit/Debit Cards, Prepaid Cards | 1.5% – 3.5% | 24/7 live chat, email, phone |

| Trustly | Varies by region | Direct Bank Transfers | 1% – 2% | 24/7 live chat, email |

| AstroPay | No minimum | Virtual Cards, Local Bank Transfers | 2% – 4% | 24/7 live chat, email |

Risk Management and Compliance

The expansion of the iGaming industry necessitates a careful approach to managing chargebacks, fraud, and compliance issues. Effective strategies are crucial to protect businesses from financial losses and maintain operational integrity.

Techniques to Mitigate Risks

- SSL Encryption, CAPTCHA, and Firewalls: To filter harmful traffic and safeguard user data.

- Multi-Factor Authentication: Verifies user identities and prevents unauthorized access.

- Document Authenticity Checks: Prevents fake registrations.

- CVV and AVS Checks: Reduces the risk of unauthorized transactions.

- Transaction Monitoring: Ensures regulatory compliance and identifies suspicious behavior.

Account-to-Account (A2A) Payments: iGaming’s Future

The iGaming industry is seeing a significant shift toward Account-to-Account (A2A) payments. These direct bank-to-bank transfers eliminate intermediaries, offering a fast, secure, and cost-effective payment method.

Benefits of A2A Payments

- High Transaction Success Rate: A2A payments have a 99% success rate across many regions, higher than card payments at 91.6%.

- Reduced Administrative Burden: By avoiding chargebacks, A2A payments reduce related costs for businesses.

Processing iGaming Payments: Simplifying Transactions

Success in iGaming relies heavily on effective payment processing. Online casinos and sportsbooks can provide seamless payment experiences by partnering with the right payment providers.

Key Features of Successful Payment Processing

| Feature | Benefits |

|---|---|

| Quick Deposits/Withdrawals | Improves player satisfaction and operational efficiency. |

| Minimal Errors | Reduces administrative costs and improves resource management. |

| Transparent Reporting | Enables data-driven decision-making and financial transparency. |

| Advanced Security Measures | Protects against data theft, hacking, and fraud, ensuring player trust. |

Alternative Payment Strategies for Online Casinos

The growth of the online casino sector demands a variety of payment methods. While traditional credit and debit cards remain essential, alternative payment options are gaining popularity.

Popular Alternative Payment Methods

| Payment Method | Benefits | Drawbacks |

|---|---|---|

| E-wallets (Skrill, EcoPayz, Neteller) | Secure, fast, convenient, private | Potential transaction fees |

| P2P and A2A Transfers (GumBallPay) | Speed, security, anonymity | Limited availability in some regions |

| Cryptocurrencies (Bitcoin, Ethereum) | Enhanced security, faster transactions | Volatility, management complexity |

| Mobile Payments (Zimpler, Tele2) | Convenience | Limited acceptance in some markets |

Fraud Prevention for iGaming Platforms

The rapid growth of online gaming has made it a prime target for fraudsters. To mitigate these risks, iGaming platforms must implement robust fraud prevention strategies.

Effective Fraud Prevention Strategies

- Advanced Security Technologies: Protect against credit card fraud, account takeovers, and bonus abuse.

- Fraud Detection Algorithms: Detect multi-accounting, promo abuse, and transaction fraud.

- Strict KYC and AML Policies: Ensure regulatory compliance and prevent money laundering.

Navigating iGaming Compliance

The iGaming industry is subject to a complex web of regulatory requirements that vary by jurisdiction. Ensuring compliant payment processing practices is crucial for maintaining a secure and transparent payment environment.

Compliance Considerations

- Currency and Payment System Support: Ensure compatibility with multiple currencies and payment methods.

- Adherence to International Standards: Follow KYC and AML regulations.

- Advanced Fraud Prevention Systems: Implement security measures like tokenization and encryption.

Blockchain Payments for iGaming Companies

The iGaming industry is increasingly embracing cryptocurrencies, driving more online casinos and sportsbooks to accept digital currencies as a payment method.

Leading Blockchain Payment Providers

| Provider | Founding Year | Supported Cryptocurrencies | Notable Features |

|---|---|---|---|

| MiFinity | 2002 | 15+ | Global user base, over 10 fiat currencies |

| CoinPayments | 2013 | 2,300+ | Secure digital asset storage |

| BitPay | 2011 | 15+ | Wide range of transaction options |

| CoinsPaid | 2014 | N/A | Processed $5 billion in crypto transactions |

Benefits and Challenges

While offering faster transactions, lower fees, and increased anonymity, the volatility of digital currencies and regulatory challenges must be carefully managed.

| Aspect | Benefits | Challenges |

|---|---|---|

| Security | Enhanced security through decentralized transactions. | Risk of hacking and security breaches if not properly managed. |

| Transparency | Clear, immutable transaction records. | Difficulty in correcting mistakes due to the immutability of blockchain. |

| Speed of Transactions | Faster transactions, especially for cross-border payments. | Network congestion can slow down transactions during peak times. |

| Cost Efficiency | Reduced fees compared to traditional payment methods. | Initial setup costs and fluctuating transaction fees. |

| Anonymity | Allows for anonymous transactions, appealing to users. | Regulatory challenges due to anonymous nature. |

| User Trust | Increases trust with verifiable transactions. | Lack of understanding can lead to user skepticism. |

| Global Reach | Easily accessible for international players. | Varying levels of blockchain adoption across different regions. |

| Compliance | Easier adherence to anti-money laundering (AML) guidelines. | Complex regulatory environment varies by jurisdiction. |

| Integration | Can be integrated with smart contracts for automated payouts. | Technical challenges in integrating with existing systems. |

| Innovation Appeal | Attracts tech-savvy users and early adopters. | Constant need to stay updated with rapidly evolving technology. |

Enhancing User Experience Through Digital Wallet Integration

Digital wallets like PayPal, Skrill, and Neteller have revolutionized the iGaming industry by providing a secure, fast, and seamless way for players to manage their funds.

Key Benefits of Digital Wallet Integration

- Secure and Fast Transactions: Prioritizes user security through advanced encryption and biometric identification.

- Simplified Transactions: Reduces the need for repeated data input, enhancing user satisfaction.

- Global Accessibility: Compatible across multiple devices and platforms, ensuring a consistent experience.

Gaming Merchant Accounts: A Comprehensive Solution

For iGaming businesses, a specialized gaming merchant account is essential for effective payment processing. These accounts handle high transaction volumes, support multiple currencies, and offer tailored solutions for risk management, fraud prevention, and regulatory compliance.

Benefits of a Gaming Merchant Account

- High Transaction Volume Handling: Supports transactions exceeding 40–50 million euros monthly.

- Risk Management: Includes tools for managing chargeback ratios and fraud.

- Regulatory Compliance: Ensures adherence to industry standards and regulations.

Conclusion

The industry’s expansion and growing need for flawless transactions force operators to prioritize safety and efficiency in their payment systems. The correct payment processing system may make all the difference in guaranteeing regulatory compliance, providing a range of payment options, or safeguarding player information.

Not to overlook the other side of the coin—player satisfaction.

While any friction can drive players to rush to a competitor, a flawless payment experience keeps them returning. If you own an iGaming company, you should review your payment processing system. Is it meeting all the criteria? If not, an upgrade could be necessary.

In the game of iGaming, after all, you do not want to be left on the bench.